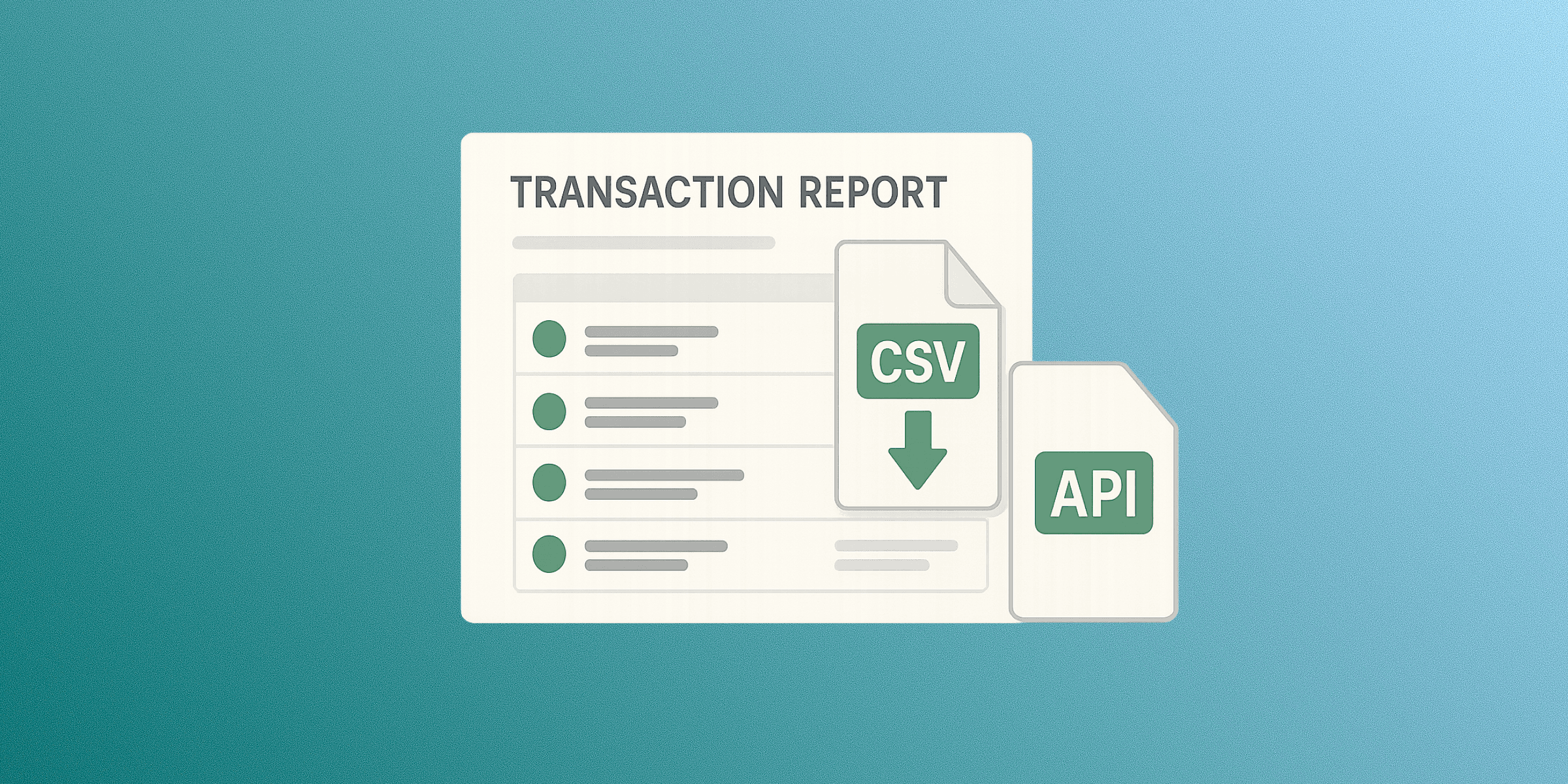

New Transactions API and CSV export

A new enriched transactions report is now available via both the API and as a downloadable CSV file from the dashboard. Configure the report by filtering on all possible fields in the Payments view and then download the report by choosing Standard Report.

You can read more in our transactions CSV export guide and the API reference.

Other things we've released:

New

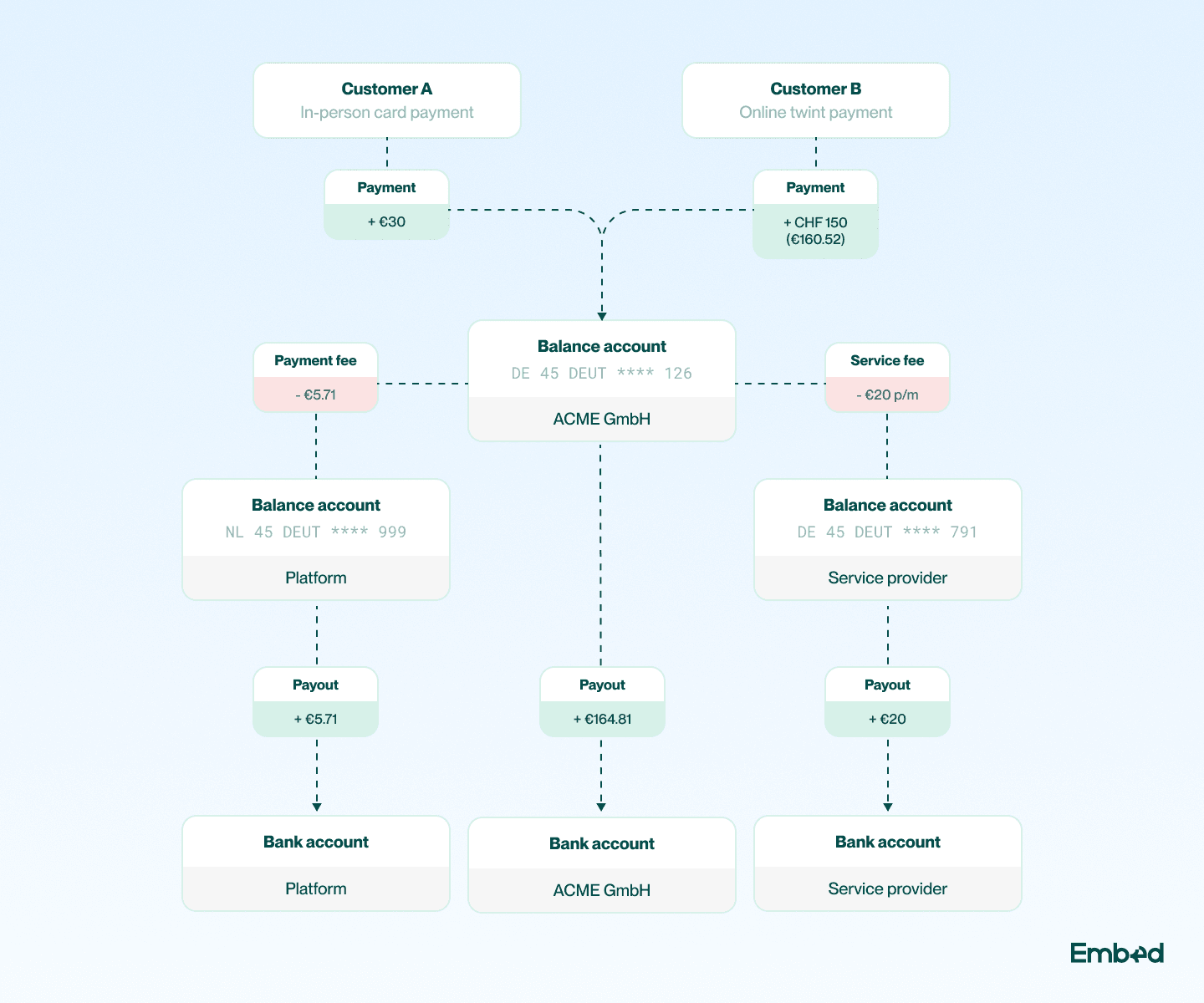

- Balance accounts can now be created and managed from the dashboard.

- You can add and configure bank accounts from the dashboard as funding instruments for top-ups and payout destinations.

Improvements

- We have improved the multi-select account filtering component in the dashboard.

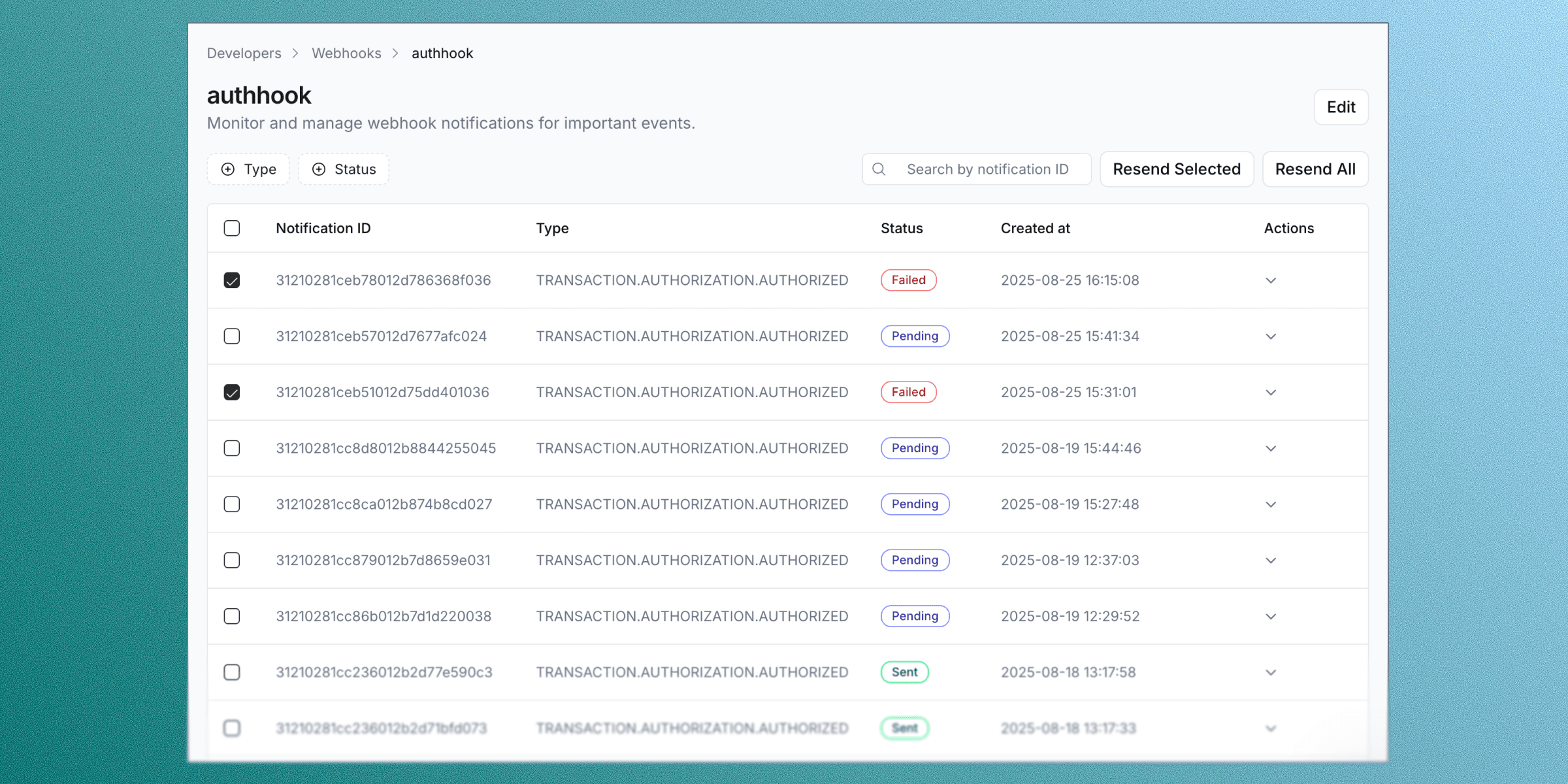

- Notification delivery now shows Pending/Delivered statuses.

Bug Fixes

- We have fixed an issue for some flows involving incremental pre-authorizations where a subsequent cancel authorization was processing successfully but the funds were not released to the cardholder immediately.